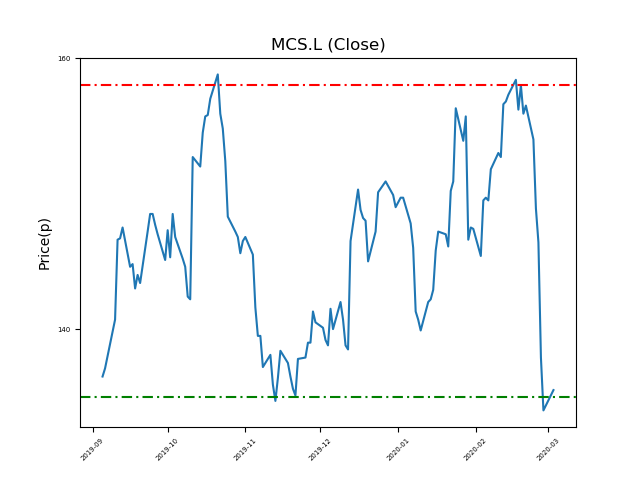

McCarthy & Stone (MCS.L) 03-03-20

McCarthy & Stone (MCS.L) shares are rangebound. Will it break support, or will it continue within the range and return to highs of 158p? (+14%)

- Currently trading around the 135p bottom of the range. Now at 136.4p (at time of writing).

- The range has proven reliable until now. Will the pattern continue?

- The price has traded within this range for a significant period. However, key levels can be broken.

- Will we continue in this range, rebounding again to recent highs of 158p? (+14%).

- News and developments can disrupt trading patterns. Check news channels regularly, act accordingly.

- Shares -14% from 12-month highs; +10% from 12 month lows.

Latest News

20 Feb: HSBC reiterates its buy rating on McCarthy Stone Plc (MCS) and increased the target price to 190p (from 160p).

05 Feb: Jefferies International has downgraded its rating on McCarthy Stone Plc (MCS) to hold (from hold).

04 Feb: UBS reiterates its sell rating on McCarthy Stone Plc (MCS) and increased the target price to 132p (from 125p).

03 Feb: Jefferies International has downgraded its rating on McCarthy Stone Plc (MCS) to hold (from buy) and reduced the target price to 168p (from 171p).

29 Jan: Deutsche Bank reiterates its buy rating on McCarthy Stone Plc (MCS) and increased the target price to 170p (from 154p).

28 Jan: McCarthy & Stone, the retirement home developer and manager, announced a 25% decline in end of year profit, blaming a challenging environment and strategic amendments.

14 Jan: Deutsche Bank has upgraded its rating on McCarthy Stone Plc (MCS) to buy (from hold) and increased the target price to 154p (from 137p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires