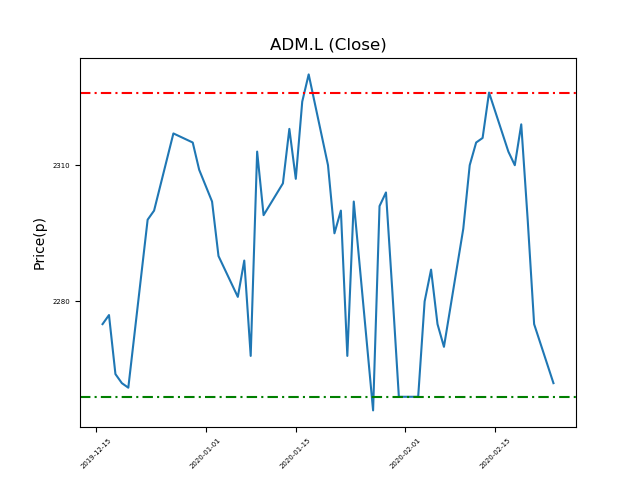

Admiral (ADM.L) 25-02-20

Admiral (ADM.L): Currently in a trading range, will it continue within the current range and return to highs of 2326p? (+3%)

- Currently trading around the 2259p support at 2253p (at time of writing).

- The range has been reliable up to now. Will it continue?

- Will the price continue in this range, returning to recent highs of 2326p? (+3%).

- Technical traders should be mindful of news and developments.

- Shares -3% from 12-month highs; +11% from 12 month lows.

Latest News

12 Feb: Peel Hunt reiterates its hold rating on Admiral Group (ADM) and increased the target price to 2230p (from 2150p).

07 Feb: Morgan Stanley reiterates its equal weight rating on Admiral Group (ADM) and increased the target price to 2100p (from 1900p).

07 Feb: Admiral, the insurance group, announced that it anticipated reporting better full year earnings due to lower UK personal injury claims, a development it said was ‘unusually positive’.

31 Jan: JP Morgan Cazenove reiterates its underweight rating on Admiral Group (ADM) and reduced the target price to 1925p (from 1950p).

21 Jan: Investec has downgraded its rating on Admiral Group (ADM) to add (from buy).

06 Dec: David Stevens, Chief Executive Officer, has transferred out 205,000 shares within the firm on the 5th December 2019. This Director currently has 8,202,950 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires