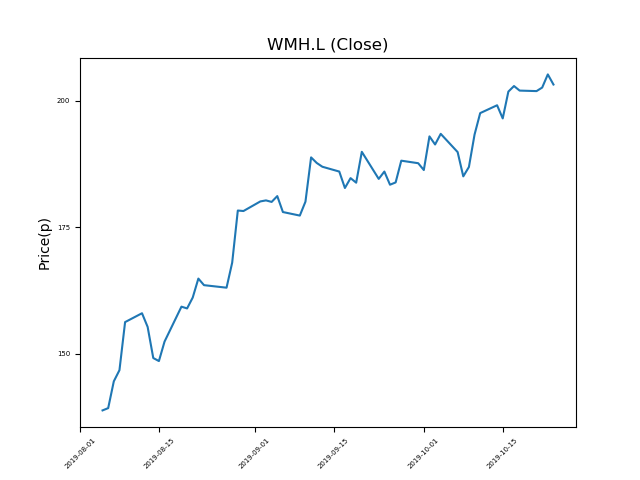

William Hill (WMH.L) 24-10-19

Will shares in William Hill (WMH.L) continue to push upwards, reaching new highs?

- Now trading at 202.8p (at time of writing), the share price momentum has been very strong.

- Will it come to an end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Shares -8% from 12-month highs; +53% from 12 month lows.

Latest News

11 Oct: JP Morgan Cazenove today initiates coverage of William Hill (WMH) with a neutral rating and target price of 180p.

07 Oct: Deutsche Bank reiterates its buy rating on William Hill (WMH) and reduced the target price to 197p (from 210p).

10 Sep: Barclays Capital reiterates its overweight rating on William Hill (WMH) and increased the target price to 226p (from 215p).

05 Sep: William Hill said that chief executive Philip Bowcock would leave his post, with effect from 30th September. He will be replaced by digital expert Ulrik Bengtsson.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires