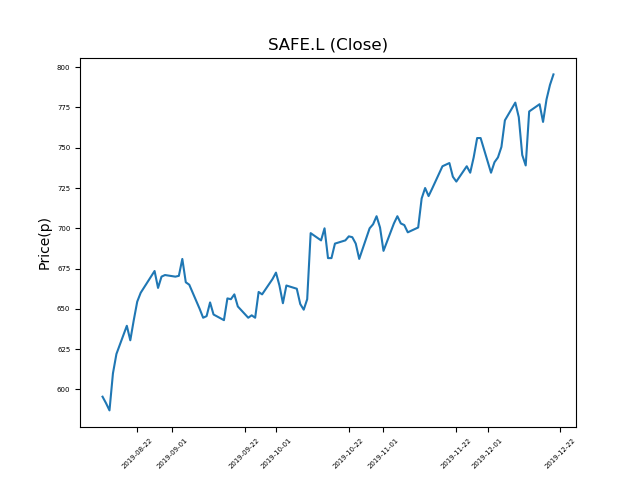

Safestore Holdings (SAFE.L) 20-12-19

Will shares in Safestore Holdings (SAFE.L) continue to rally, setting new recent highs?

- Now trading at 791p (at time of writing), the share price performance has been very strong.

- Will it come to an end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Whilst momentum has been strong, traders should remember that past performance is not necessarily an indication of the future.

- Technical traders should be mindful of new events, which can influence price action. Check our website and news outlets for updates.

- Shares -0% from 12-month highs; +56% from 12 month lows.

Latest News

17 Dec: Peel Hunt reiterates its hold rating on Safestore Holdings (SAFE) and increased the target price to 800p (from 625p).

27 Nov: Safestore, the self storage company, announced that David Hearn would become its new chairman, to take up his post from the new year. Hearn was previously chairman of A2 Milk Company in New Zealand.

14 Nov: Safestore Holdings posted a 5.6% rise in revenues for Q4. UK performance in the quarter was strong, with total revenue growing by 5.9%.

12 Sep: Liberum Capital reiterates its buy rating on Safestore Holdings (SAFE) and increased the target price to 710p (from 650p).

04 Sep: Frederic Vecchioli, CEO, exercised 18,475 shares in the firm on the 3rd September 2019 at a price of 164p. This Director currently has 1,916,227 shares.

04 Sep: Andy Jones, Financial Director, exercised 18,475 shares in the firm on the 3rd September 2019 at a price of 164p. This Director currently has 419,511 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires