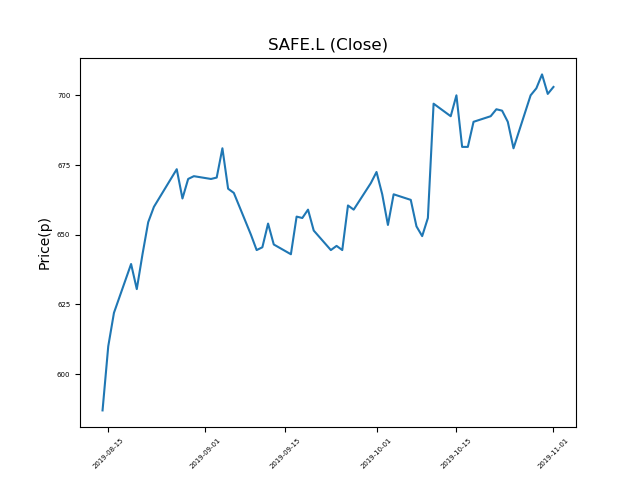

Safestore Holdings (SAFE.L) 01-11-19

Will Safestore Holdings (SAFE.L) continue this relentless rise, setting new highs?

- Currently trading at 696.5p (at time of writing), performance has been exceptional of late.

- Will it hit resistance, or is the trend your friend?

- Is this one for momentum traders?

- The price has been moving upwards, however, past performance is not necessarily an indication of the future.

- Technical traders should be mindful of breaking news and events. This can influence price trends. Check our website and news outlets for updates.

- Shares -1% from 12-month highs; +37% from 12 month lows.

Latest News

12 Sep: Liberum Capital reiterates its buy rating on Safestore Holdings (SAFE) and increased the target price to 710p (from 650p).

04 Sep: Frederic Vecchioli, CEO, exercised 18,475 shares in the firm on the 3rd September 2019 at a price of 164p. This Director currently has 1,916,227 shares.

04 Sep: Andy Jones, Financial Director, exercised 18,475 shares in the firm on the 3rd September 2019 at a price of 164p. This Director currently has 419,511 shares.

19 Aug: Safestore, the storage company, stated it had entered into a joint venture with Carlyle European Real Estate Fund for the acquisition of M3 Self Storage. Safestore would obtain a 20% equity stake in the company.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires