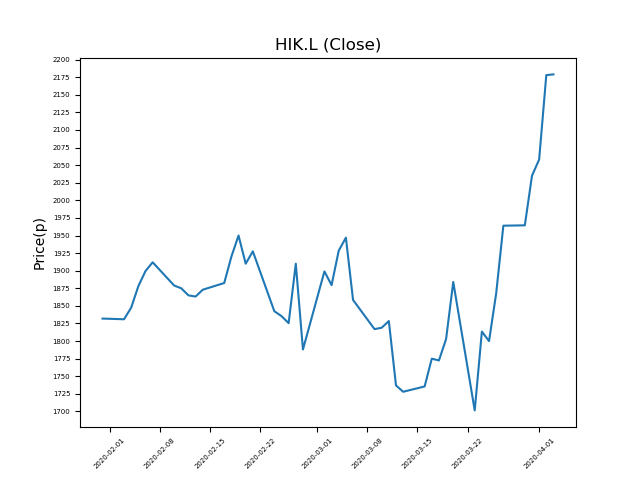

Hikma Pharmaceuticals PLC (HIK.L) 03-04-20

Will shares in Hikma Pharmaceuticals PLC (HIK.L) continue to rally, setting new recent highs?

- Now trading at 2198p (at time of writing), the share price performance has been very strong.

- Will it end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Whilst momentum has been strong, traders should remember that past performance is not necessarily an indication of the future.

- Technical traders should consider of new events, which can influence price action. Check our website and news outlets for updates.

- Shares -0% from 12-month highs; +39% from 12 month lows.

Latest News

09:50: Citigroup reiterates its buy rating on Hikma Pharmaceuticals (HIK) and increased the target price to 2500p (from 2150p).

02 Apr: Peel Hunt has upgraded its rating on Hikma Pharmaceuticals (HIK) to buy (from hold) and increased the target price to 2380p (from 1990p).

31 Mar: Hikma Pharmaceuticals announced that a U.S. ruling that patents covering Amarin’s heart drug were not valid, meaning the company can sell generic versions.

12 Mar: Jefferies International reiterates its buy rating on Hikma Pharmaceuticals (HIK) and increased the target price to 2390p (from 2300p).

10 Mar: Citigroup has upgraded its rating on Hikma Pharmaceuticals (HIK) to buy (from neutral) and increased the target price to 2150p (from 1980p).

02 Mar: Barclays Capital reiterates its equal weight rating on Hikma Pharmaceuticals (HIK) and increased the target price to 1950p (from 1900p).

27 Feb: Hikma Pharmaceuticals posted an increase in profits as cost reductions and better revenues supported performance.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires