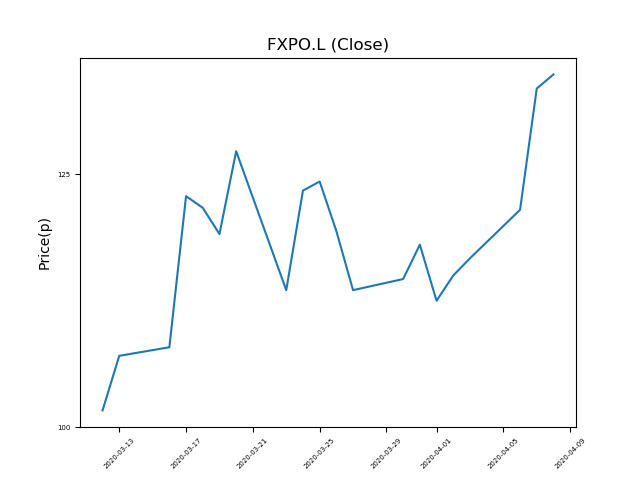

Ferrexpo (FXPO.L) 08-04-20

Will shares in Ferrexpo (FXPO.L) continue to push upwards, reaching new highs?

- Now trading at 134.8p (at time of writing), the share price momentum has been very strong.

- Will it come to an end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Shares -55% from 12-month highs; +32% from 12 month lows.

Latest News

07 Apr: Credit Suisse reiterates its outperform rating on Ferrexpo (FXPO) and reduced the target price to 190p (from 200p).

07 Apr: Ferrexpo, the iron ore miner, announced that it anticipated higher Q1 sales as a result of a 7% jump in pellet production. Management announced that it expected sales within Q1 to rise to around 2.6m.

18 Mar: Ferrexpo posted an increase in earnings, driven by better sales at higher prices. For the year ended 31 December 2019, pre-tax earnings jumped by 18% to $459.6m.

31 Jan: Ferrexpo said a Ukrainian court had frozen its stake in Ferrexpo Poltava Mining amid a corruption probe into Kostyantin Zhevago, who temporarily stepped down as the company’s CEO last…

15 Jan: Barclays Capital reiterates its underweight rating on Ferrexpo (FXPO) and increased the target price to 140p (from 110p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires