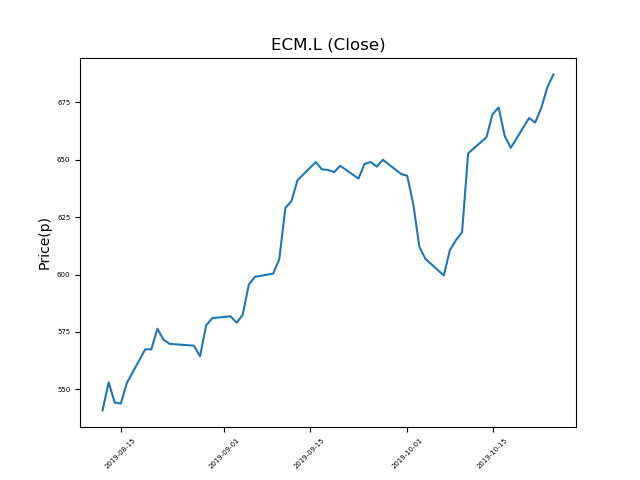

Electrocomponents (ECM.L) 28-10-19

Will Electrocomponents (ECM.L) continue this relentless rise, setting new highs?

- Currently trading at 688.8p (at time of writing), performance has been exceptional of late.

- Will it hit resistance, or is the trend your friend?

- Is this one for momentum traders?

- The price has been moving upwards, however, past performance is not necessarily an indication of the future.

- Technical traders should be mindful of breaking news and events. This can influence price trends. Check our website and news outlets for updates.

- Shares -0% from 12-month highs; +43% from 12 month lows.

Latest News

09 Oct: JP Morgan Cazenove reiterates its neutral rating on Electrocomponents (ECM) and increased the target price to 661p (from 591p).

08 Oct: Electrocomponents announced like-for-like revenue up 5% in H1, as a strong performance in its industrial markets offset slower growth in electronics and a challenging economic environment.

24 Jul: David Egan, Financial Director, has transferred in 276,157 shares in the firm on the 22nd July 2019. This Director currently has 494,290 shares.

24 Jul: David Egan, Financial Director, sold 130,250 shares in the firm on the 22nd July 2019 at a price of 593.60p. This Director currently has 364,040 shares.

24 Jul: Lindsley Ruth, CEO, has transferred in 473,412 shares in the firm on the 22nd July 2019. This Director currently has 668,727 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires