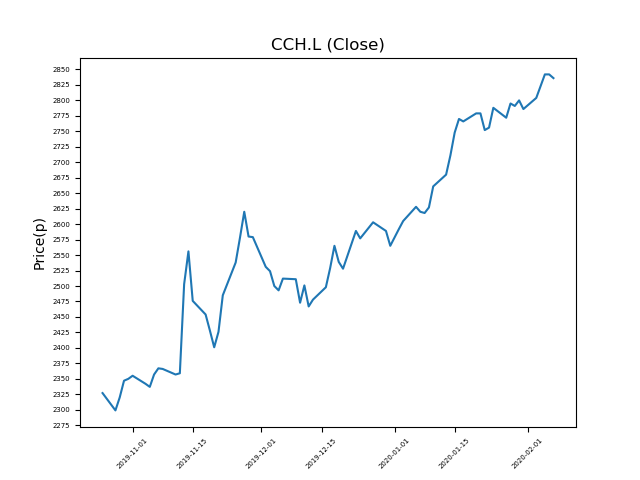

Coca-Cola HBC AG (CCH.L) 07-02-20

Will shares in Coca-Cola HBC AG (CCH.L) continue to rally, setting new recent highs?

- Now trading at 2829p (at time of writing), the share price performance has been very strong.

- Will it come to an end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Whilst momentum has been strong, traders should remember that past performance is not necessarily an indication of the future.

- Technical traders should be mindful of new events, which can influence price action. Check our website and news outlets for updates.

- Shares -8% from 12-month highs; +23% from 12 month lows.

Latest News

16 Jan: Deutsche Bank reiterates its buy rating on Coca-Cola HBC (CCH) and increased the target price to 3100p (from 3000p).

15 Jan: JP Morgan Cazenove reiterates its overweight rating on Coca-Cola HBC (CCH) and increased the target price to 2900p (from 2800p).

18 Dec: Zoran Bogdanovic, Chief Executive Officer, bought 216 shares within the firm on the 18th December 2019 at a price of 2510.87p. This Director currently has 1,273 shares.

10 Dec: JP Morgan Cazenove reiterates its overweight rating on Coca-Cola HBC (CCH) and increased the target price to 2800p (from 2700p).

27 Nov: Credit Suisse reiterates its outperform rating on Coca-Cola HBC (CCH) and increased the target price to 3050p (from 3000p).

19 Nov: Michalis Imellos, Director, bought 93 shares within the firm on the 18th November 2019 at a price of 2450.78p. This Director currently has 8,966 shares.

19 Nov: Zoran Bogdanovic, Chief Executive Officer, bought 225 shares within the firm on the 19th November 2019 at a price of 2450.78p. This Director currently has 12,515 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires