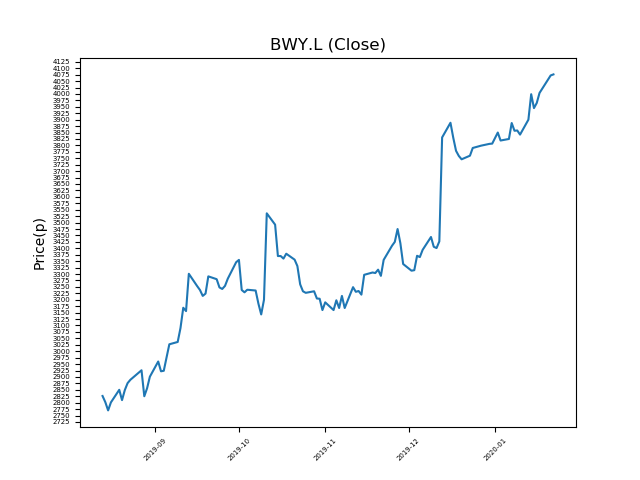

Bellway. (BWY.L) 22-01-20

Will Bellway. (BWY.L) continue to rise?

- Now trading at 4061p (at time of writing), the share price momentum has been strong.

- Is this trend your friend?

- Could this appeal to momentum investors?

- Whilst the trend has been strong, remember that past patterns are not necessarily an indication of the future.

- Be mindful of new events and the influence they can have on price action. Check regularly for updates.

- Shares -0% from 12-month highs; +50% from 12 month lows.

Latest News

14 Jan: Deutsche Bank reiterates its buy rating on Bellway (BWY) and increased the target price to 4132p (from 3538p).

13 Jan: Peel Hunt has upgraded its rating on Bellway (BWY) to add (from hold) and increased the target price to 4330p (from 3550p).

09 Jan: Berenberg reiterates its buy rating on Bellway (BWY) and increased the target price to 4220p (from 3560p).

07 Jan: Canaccord Genuity reiterates its buy rating on Bellway (BWY) and increased the target price to 4260p (from 3590p).

04 Dec: UBS reiterates its buy rating on Bellway (BWY) and increased the target price to 3700p (from 3600p).

27 Nov: Liberum Capital reiterates its buy rating on Bellway (BWY) and increased the target price to 3750p (from 3500p).

22 Nov: HSBC reiterates its buy rating on Bellway (BWY) and increased the target price to 4300p (from 4290p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires