AstraZeneca PLC (AZN.L) 20-01-20

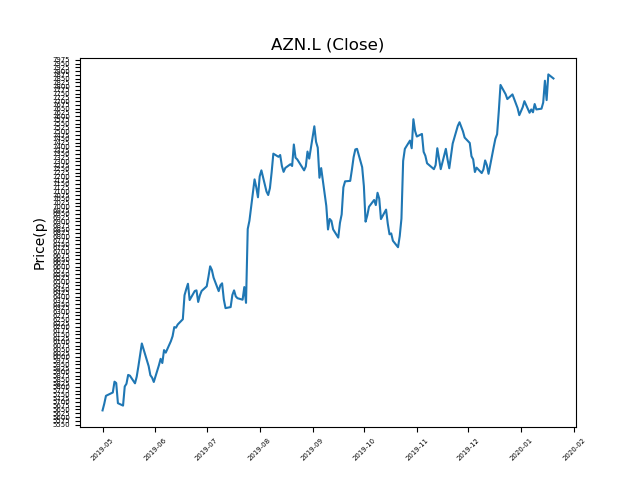

Will shares in AstraZeneca PLC (AZN.L) continue to new highs?

- The share price performance has been very strong, now trading at 7835p (at time of writing), .

- Will we see an end to the trend, or is the momentum set to continue?

- Could this be the ideal opportunity for those seeking a momentum play?

- Whilst the trend has been relentless, remember that strong past performance may not always continue.

- Technical traders should be mindful of new events, which can influence price action. Check our website and news outlets for updates.

- Shares -0% from 12-month highs; +47% from 12 month lows.

Latest News

07:27: AstraZeneca, the pharmaceutical group, announced that its liver cancer drug had been given ‘orphan drug’ status with the FDA in the US.

16 Jan: Credit Suisse reiterates its outperform rating on AstraZeneca (AZN) and increased the target price to 8500p (from 8200p).

16 Jan: Barclays Capital reiterates its overweight rating on AstraZeneca (AZN) and increased the target price to 8500p (from 8300p).

13 Jan: AstraZeneca and Merck announced that their new drug used to treat ovarian cancer was designated for priority review by the FDA in the US.

06 Jan: Morgan Stanley reiterates its equal weight rating on AstraZeneca (AZN) and increased the target price to 8100p (from 7400p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires