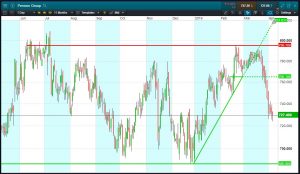

The UK 100 index continues to consolidate 7437-7480, pausing to digest the latest March/April leg higher within a pre-existing 4-month up-channel. After last week’s Brexit delay boost, the index has failed to benefit from any additional GBP weakness. Results season has also yet to provide any big name influencers to help drive the index above the…

Brexit has been a pain for many industries throughout these past 3 years. House builders and buyers haven’t been spared. However, it seems as though the industry has been making a killing of late as Brexit fatigue sets in. And with the UK’s EU exit being delayed until October 31st, the housing market has started…

Results season is upon us again. Time for a refresher on corporate lingo. Management verbiage can be a minefield for retail investors. Next time you read about business performance, I hope this will make things clearer. Sales, revenues and profits sound so very impressive when described in their millions, if not billions. But what’s more…

The piece I wrote on Support last week was well received, thanks to the range of charts I used, which bounced 2-12%. So I’ll continue the theme by revisiting another retail investor favourite: Fallers. If you’re expecting a list of names which fell sharply this week and could be due a bounce, you’re out of luck. I’ve…

Since the 1st of Jan the UK 100 is up 900 points, from lows of 6,500 to current highs of 7400. In one of the best starts to the year for a decade…Brexit? What Brexit?! 47% of UK 100 members have risen in excess of 10%. One sector which has had a stellar first quarter: Mining. All…

The UK 100 index has bounced off the floor of its 3-month up-channel. This comes thanks to fresh GBP weakness, driven by uncertainty about Brexit. If the PM fails to push her deal through Parliament, to delay Brexit until May, and another round of indicative votes on Monday fail to deliver a Commons consensus, the…