BBGI Sicav S.A. (BBGI.L) 07-04-20

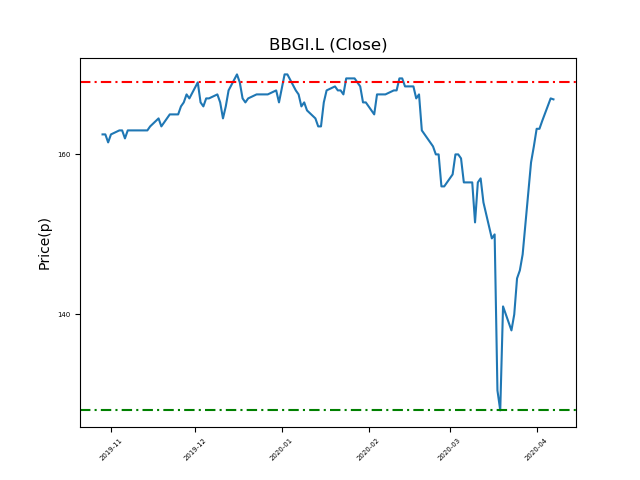

Will BBGI Sicav S.A. (BBGI.L) break the key resistance line this time, or will it retest the 128p support once more? (-23%)?

- Currently trading at 166.2p, close to the 169p resistance (at time of writing).

- Will the share price fall to recent support of 128p? (-23%).

- Check the Accendo website and other news outlets for updates. Trading patterns can be disrupted by company news and world events.

- Shares -2% from 12-month highs; +29% from 12 month lows.

Latest News

27 Mar: Colin Maltby, Chairman, bought 9,196 shares within the firm on the 26th March 2020 at a price of 145.00p. This Director currently has 132,000 shares.

30 Aug: BBGI, the infrastructure company, posted an increase in net assets within H1, driven by underlying portfolio growth.

18 Jun: BBGI announced intentions to raise up to £75m through a share placing at a premium. The capital would be earmarked to reduce debt and seek new investments.

13 Jun: BBGI SICAV built a higher stake in the A1/A6 public private partnership road project in the Holand, investing another £58m.

24 May: Duncan Ball, Chief Executive Officer, sold 319,000 shares within the firm on the 23rd May 2019 at a price of 155.91p. This Director currently has 430,679 shares.

24 May: Frank Schramm, Chief Executive Officer, sold 319,000 shares within the firm on the 23rd May 2019 at a price of 155.91p. This Director currently has 418,080 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires