Complex environment

When trading shares and share CFDs, investors must consider things such as corporate results (the company’s and its peers’), consensus forecasts, broker updates, the economic environment and technical indicators.

When analysing the index CFD, the number of things to take into consideration grows by several orders of magnitude. Indices may seem like monolithic financial products on the outside, but each is comprised of tens, hundreds, even thousands of constituents, each pushing and pulling on the index.

On any given day, each of the UK 100 companies can have a positive or negative influence on the index, for their own reasons. To many retail investors, keeping track of such a huge quantity of companies and all the other external influences (FX, geopolitics, sector read-across, etc.) is simply too daunting.

Measuring volatility

Investors often believe that equity indices like the UK 100 , DAX and Nasdaq offer bigger tradable swings, volatility and profits because of their exposure to a multitude of geopolitical and macroeconomic factors, such the global trade conflict or Brexit.

When markets are in an established trend, upwards or downwards, it can sometimes seem easier to put your money into the UK Index 100 blue-chip index rather than stock-pick individual names, which can move in different directions to the general market. But while seemingly more straightforward, buying and selling index CFDs doesn’t necessarily offer the same potential returns as a more in-depth research-based approach can bring.

For those investors who prefer holding financial instruments over the long-term, indices offer a mixed bag of recent results. The UK 100 is flat since the beginning of the year, while being only +0.7% in the past month. Currencies have fared similarly. Cable (GBP/USD) is -0.7% over the last month and down -2.9% since the beginning of the year. In daily trading, major indices rarely move more than 1-2%, while currencies typically exhibit even lower levels of daily volatility. (Source: AlphaTerminal, 1 August 2018)

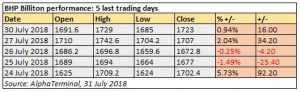

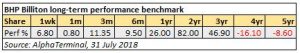

By comparison, individual UK 100 shares can regularly offer 5-10% daily ranges. Major companies such as BT and BHP Billiton are up more than 7% in the last week, whilst trading -13.2% and +13.5% year-to-date, respectively. (Source: AlphaTerminal, 31 July 2018) Whether you are a proverbial bull or a bear, buying or selling equities, individual UK 100 components have just as much potential (in some cases even more) to offer superior trading ranges, whether holding those shares for the long-term or while trading the daily high-low range.