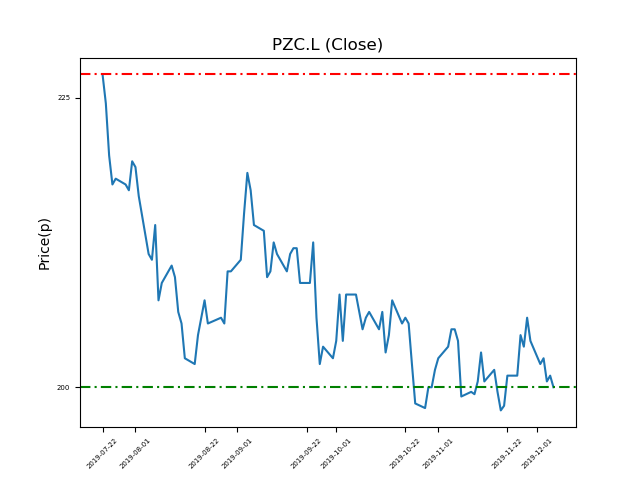

PZ Cussons (PZC.L) 09-12-19

Are PZ Cussons (PZC.L) about to break below the 200p support zone, or recover again to 227p highs? (+12%)

- The share price is close to 200p support. Shares are 201p (at time of writing).

- The support has proven robust to date. Will it stand firm this time?

- The shares have touched this level numerous times.

- Check our website and news outlets for updates. Fundamental developments can affect the strength of support levels.

- Shares -11% from 12-month highs; +12% from 12 month lows.

Latest News

30 Oct: PZ Cussons, the consumer goods company, announced that Paul Grimwood and Kirsty Bashforth have been appointed as non-Executive Directors.

25 Sep: PZ Cussons stated that results for the year would likely show no improvement on the previous year, due to tough markets in the UK, Nigeria and Australia.

29 Aug: PZ Cussons has agreed to sell Minerva, its Greek food business, as well as Luksja, its Polish personal care business.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires