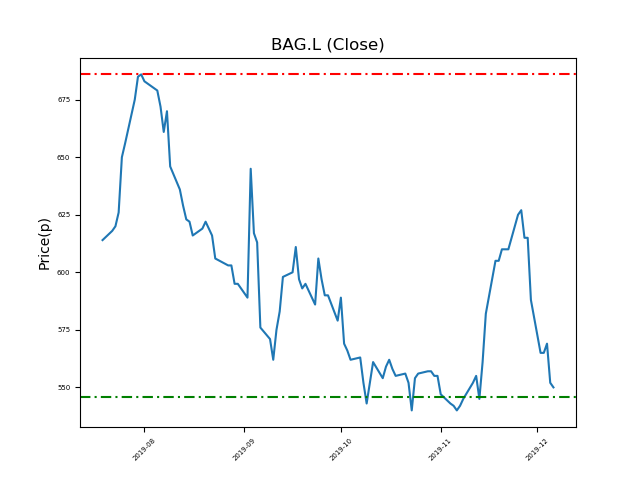

A.G. BARR. (BAG.L) 09-12-19

Will A.G. BARR. (BAG.L) shares break below the 546p support, or return to highs of 686p (+24%)?

- Currently close to the 546p support at 549.7p (at time of writing).

- This has been identified for ostensibly strong support level. Traders should consider whether they think it will hold up again.

- Will the price bounce again to recent highs at 686p? (+24%).

- Technical traders should consider potential news and developments. Check our website and the press for updates in future.

- Shares -43% from 12-month highs; +1% from 12 month lows.

Latest News

08 Oct: Barclays Capital reiterates its underweight rating on Barr (A G) (BAG) and reduced the target price to 520p (from 590p).

24 Sep: Liberum Capital today initiates coverage of Barr (A G) (BAG) with a hold rating and target price of 580p.

08 Aug: Jonathan Kemp, Executive Director, bought 23 shares in the firm on the 7th August 2019 at a price of 664p. This Director currently has 18,856 shares.

08 Aug: Andrew Memmott, Executive Director, bought 23 shares in the firm on the 7th August 2019 at a price of 664p. This Director currently has 110,210 shares.

08 Aug: Roger White, CEO, bought 23 shares in the firm on the 7th August 2019 at a price of 664p. This Director currently has 9,247 shares.

08 Aug: Stuart Lorimer, Financial Director, bought 23 shares in the firm on the 7th August 2019 at a price of 664p. This Director currently has 37,279 shares.

24 Jul: Stuart Lorimer, Financial Director, bought 10,414 shares in the firm on the 23rd July 2019 at a price of 616.19p. This Director currently has 15,671 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires