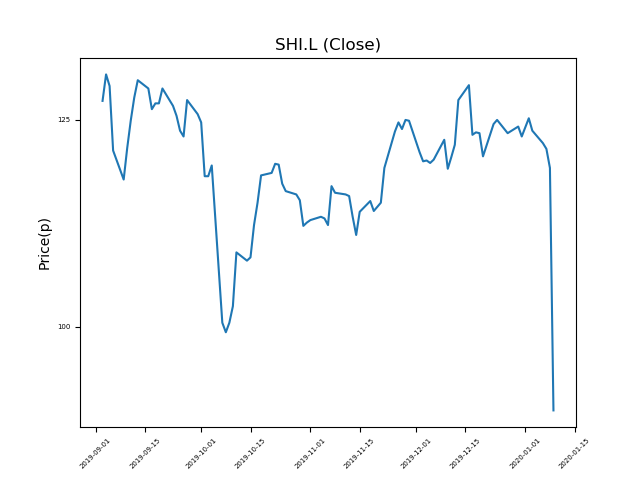

SIG (SHI.L) 09-01-20

Shares in SIG (SHI.L) have fallen notably from recent highs of 130.5p. Will the trend prevail, or is this an opportunity for you to pick up a bargain?

- Currently at 94.7p (at time of writing). A move up to highs would represent a rise of 37%.

- These share are amongst the biggest fallers in the period.

- Is the move unfinished, or are we about to see a bounce?

- The market has been known to over-react to bad news. Investors should consider whether these falls are justified, or is this an over-reaction?

- Shares -38% from 12-month highs; +5% from 12 month lows.

Latest News

09:30: Peel Hunt has downgraded its rating on SIG (SHI) to hold (from buy) and reduced the target price to 115p (from 165p).

07:46: SIG, the specialist building material supplier, has posted a 6.1% fall in like-for-like revenues for the full year.

02 Dec: Jefferies International reiterates its hold rating on SIG (SHI) and reduced the target price to 122p (from 142p).

18 Nov: NIck Maddock, Executive Director, bought 135 shares in the firm on the 15th November 2019 at a price of 110.70p. This Director currently has 153,056 shares.

10 Oct: UBS reiterates its sell rating on SIG (SHI) and reduced the target price to 88p (from 93p).

09 Oct: NIck Maddock, Executive Director, bought 74,000 shares in the firm on the 9th October 2019 at a price of 102.30p. This Director currently has 152,921 shares.

08 Oct: Andrew Allner, Chairman, bought 16,000 shares in the firm on the 8th October 2019 at a price of 99.75p. This Director currently has 59,954 shares. NOTE: Average price over 2 transactions

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires