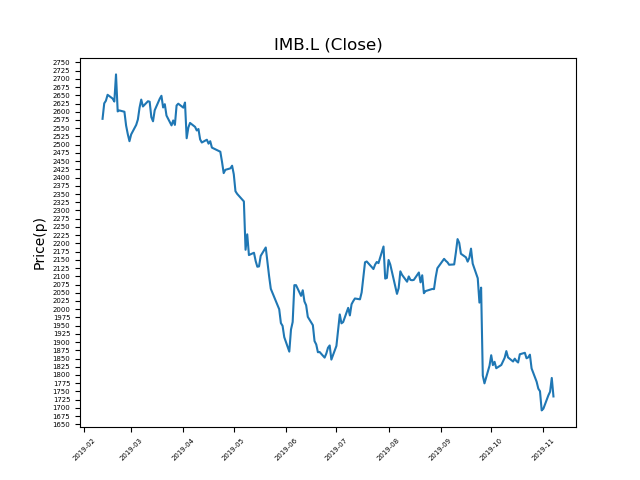

Imperial Brands PLC (IMB.L) 07-11-19

Shares in Imperial Brands PLC (IMB.L) have fallen notably from recent highs of 2713.5p. Will the trend prevail, or is this an opportunity for you to pick up a bargain?

- Currently at 1796.4p (at time of writing). A move up to highs would represent a rise of 51%.

- These share are amongst the biggest fallers in the period.

- Is the move unfinished, or are we about to see a bounce?

- The market has been known to over-react to bad news. Investors should consider whether these falls are justified, or is this an over-reaction?

- Shares -34% from 12-month highs; +6% from 12 month lows.

Latest News

11:00: UBS reiterates its neutral rating on Imperial Brands Plc (IMB) and reduced the target price to 1790p (from 1900p).

06 Nov: Credit Suisse reiterates its outperform rating on Imperial Brands Plc (IMB) and reduced the target price to 3000p (from 3300p).

05 Nov: Imperial Brands, the tobacco company, had a more cautious outlook after annual results came in worse than expected. It said that its vaping business unit in the US was adversely affected by uncertainty around future regulations.

04 Nov: Jefferies International reiterates its buy rating on Imperial Brands Plc (IMB) and reduced the target price to 2400p (from 3800p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires