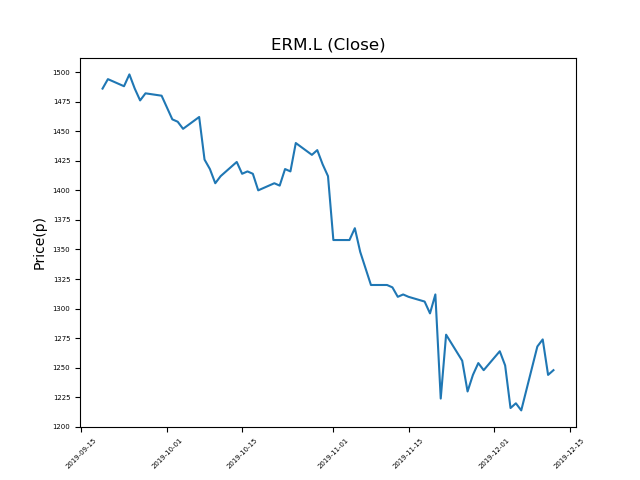

Euromoney Institutional Investor PLC (ERM.L) 12-12-19

Euromoney Institutional Investor PLC (ERM.L) shares have fallen significantly from the most recent highs of 1498p. Will it continue, or is this an opportunity to pick some up?

- A return to previous highs would represent a rise of 19%. Now at 1252p (at time of writing).

- This is one of the biggest fallers of late.

- Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -16% from 12-month highs; +10% from 12 month lows.

Latest News

11 Dec: Peel Hunt has upgraded its rating on Euromoney Institutional Investor (ERM) to buy (from add).

25 Nov: UBS reiterates its neutral rating on Euromoney Institutional Investor (ERM) and reduced the target price to 1335p (from 1375p).

25 Nov: Euromoney Investors, the information company, has acquired Wealth-X for $20.4m. Wealth-X is a data processor about high net worth individuals. The deal is expected to improve revenue growth at the group.

21 Nov: Euromoney announced that yearly results were marginally better than expectations. Upward momentum in its market intelligence, pricing and data products was dampened a little by weakness in its asset management business.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires