What a difference a quarter can make for UK 100 index of London’s blue chips. After rising through most of the spring to reach new record highs of 7903 in late May, much of the index’s hard-earned gains evaporated in the summer’s heatwave alongside hopes and dreams of England’s football squad.

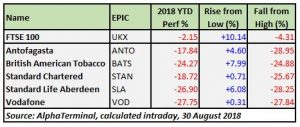

Many investors who prefer to trade for the long term are likely disappointed by moribund index performance, with UK 100 -2.15% year-to-date, and are looking for more volatile trading options that offer big market moves in the short term.

One strategy that is favoured by UK Index investors is to seek out undervalued companies that have lost a significant percentage of their share price and can offer attractive potential for a bounce back to what investors feel represents their “fair value”. But how can they be found? Is any nominally cheap stock a tradable opportunity or is there more to this search?

Here’s a hint: be on the lookout for smoke signals to find a great bargain blue chip stock.

Search criteria

With 49 of UK Index ’s 100 big name components technically negative since the beginning of the year, investors are spoiled for choice in terms of picking up cheaper stocks leading into September’s anticipated uptick in market volatility.

But not all UK 100 bargain stocks are alike. Shares of companies like Micro Focus may be nearly 48% below 2018 highs, but they already bounced around 69% from the lows, potentially exhausting their upside potential in the medium term.

The key to spotting an attractive bargain opportunity lies in balancing the “cheapness” of the stock with a reliable support level. Even better would be to see a small rebound that partially retraces prior losses to indicate that shares don’t plan to go even lower, without consuming too much of the upside.

State of the UK Index

Speaking of UK 100 as a whole, two key themes dominated the index this year: growing possibility of the so-called “no-deal Brexit” and the impact of the spreading global trade war.

Negotiations between government envoys on the orderly withdrawal from the political bloc are at an impasse over conditions for future UK/EU customs relationship and border status. Deadline for final agreement has been pushed back repeatedly, raising the likelihood that no agreement would be reached in time before final 29 March 2019 Brexit deadline.

This creates uncertainty for UK 100 companies that are exposed to EU markets through trading relationships, need for market access or capital inflows.

On a more global scale, the multilateral “trade war” between China, US and EU is also hitting hard those UK 100 shares that are either commercially tied to China and other tariff-impacted markets or face significant FX headwinds from the appreciating US Dollar. As most commodities are priced in USD, a sustained recent Dollar rally that is supported by American protectionist policies is hitting the UK Index ’s heavyweight resource sector hard.

Continue reading for more specific examples of UK 100 stocks that have seen significant devaluation in the first half of the year.

For additional analytical coverage of key UK 100 companies, you can also sign up to have our research sent directly to your inbox.