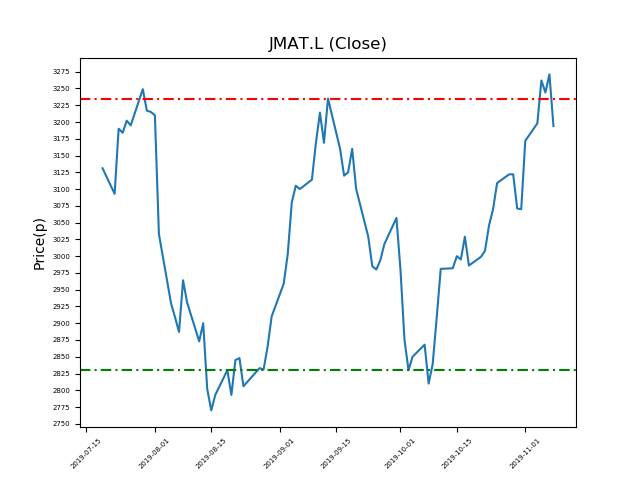

Johnson Matthey (JMAT.L) 08-11-19

Johnson Matthey (JMAT.L): will resistance fail, or will the price continue within the current range and return to 2830p?(-11%)

- Now close to the 3235p resistance. The current price is 3197.0p (at time of writing).

- This might appeal to short-sellers.

- The range has been reliable. Will the pattern repeat itself?

- The price has tested this level in the recent past. Be mindful of stop-loss placement in case the range fails.

- Will the shares continue to trade in this range, declining again to lows at 2830p? (-11%).

- Shares -7% from 12-month highs; +22% from 12 month lows.

Latest News

23 Oct: Credit Suisse reiterates its outperform rating on Johnson Matthey (JMAT) and reduced the target price to 3900p (from 4200p).

10 Sep: Johnson Matthey announced that it had agreed to supply methanol technology to Methanex’s new plant, soon to be built in Louisiana.

22 Aug: Anna Manz, Executive Director, bought 12 shares in the firm on the 21st August 2019 at a price of 2845.07p. This Director currently has 26,835 shares.

22 Aug: John Walker, Executive Director, bought 12 shares in the firm on the 21st August 2019 at a price of 2845.07p. This Director currently has 17,024 shares.

22 Aug: Robert MacLeod, CEO, bought 12 shares in the firm on the 21st August 2019 at a price of 2845.07p. This Director currently has 58,886 shares.

06 Aug: Robert MacLeod, CEO, has transferred in 11,696 shares in the firm on the 2nd August 2019. This Director currently has 60,535 shares.

06 Aug: Robert MacLeod, CEO, sold 666 shares in the firm on the 2nd August 2019 at a price of 3165.85p. This Director currently has 53,839 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires