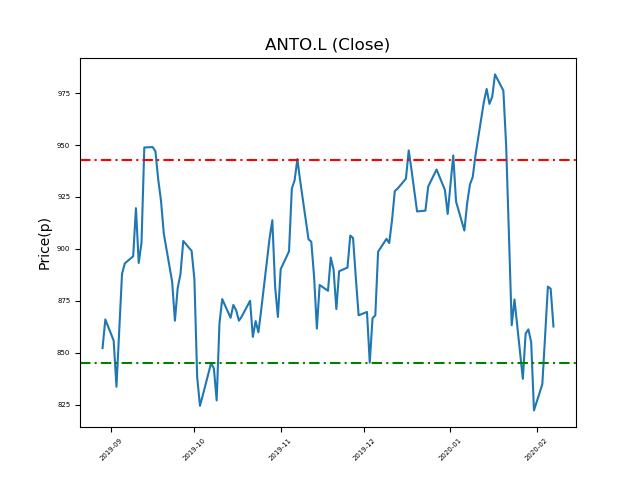

Antofagasta (ANTO.L) 07-02-20

Antofagasta (ANTO.L): currently trading within a range. Will support be broken, or will the range prevail and send the price back to highs of 943p? (+16%)

- Now trading around the 845p support at 857.8p (at time of writing).

- Will the range continue? It has proven reliable recently.

- The top end of this range has been 943p? (+16%).

- Technical traders might seek to place stop losses outside of this range, in case of breakout.

- Shares -16% from 12-month highs; +10% from 12 month lows.

Latest News

05 Feb: Deutsche Bank has upgraded its rating on Antofagasta (ANTO) to hold (from sell) and increased the target price to 850p (from 840p).

30 Jan: Goldman Sachs reiterates its neutral rating on Antofagasta (ANTO) and increased the target price to 910p (from 890p).

28 Jan: Peel Hunt reiterates its hold rating on Antofagasta (ANTO) and increased the target price to 940p (from 915p).

23 Jan: RBC Capital Markets reiterates its sector performer rating on Antofagasta (ANTO) and reduced the target price to 850p (from 900p).

22 Jan: JP Morgan Cazenove reiterates its underweight rating on Antofagasta (ANTO) and increased the target price to 790p (from 780p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires