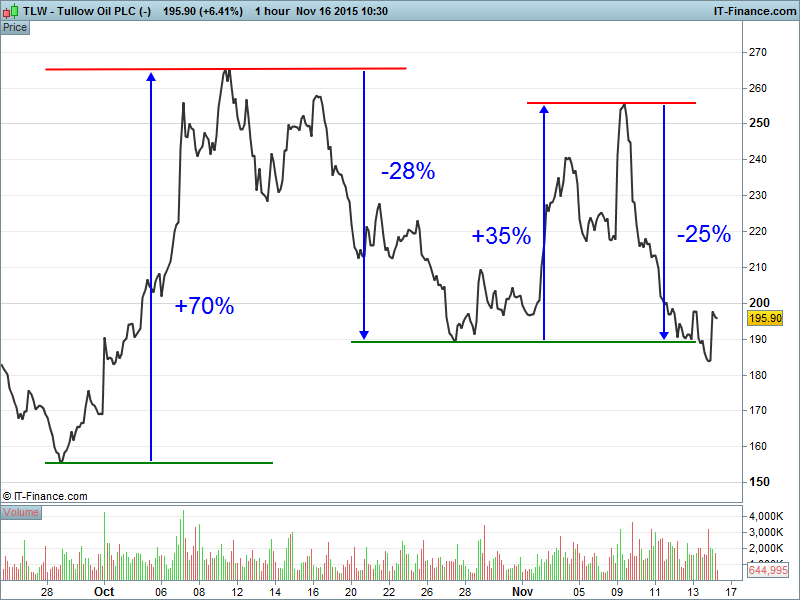

Volatile times in the commodities sector

The period 28 Sept. – 12 Nov. saw some incredible share price moves in the commodities and basic materials sectors with drivers including US interest rates, Chinese demand and the continuing battle over oil market share between OPEC and non-OPEC producers. While this period has been particularly volatile given what looks like an impending US rate hike scheduled for December, the theme has remained fairly constant throughout 2015. Importantly, it looks as if it will continue for the foreseeable future. How can investors play this situation to their benefit?

While many are lamenting falling commodity prices in terms of a general long term trend, it’s often useful to consider the short term too. When one does this, a multitude of trading opportunities becomes apparent – even to the traditional long only investor.