The information on this page is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

A stop loss is an automatic order to close a trade when the price reaches a set level. They are key for CFD and SpreadBet traders in terms of stopping losses getting any worse and protecting profits from erosion.

There’s a well-known saying in trading: “let profits run and cut losses early“. Closing a position which is going wrong early enough allows you take stock of a situation, with capital still intact, and to look for a better opportunity.Leaving a losing position, hoping that “it’ll come back” can be dangerous.

Trading using CFDs/Spread Bets allows you to change tack quickly, from bullish to bearish in seconds. Knowing when to change your mind can mean the difference between a small and a big loss. A few decent profits versus a few small losses makes a profitable trader. Below are some tools for minimising losses and preserving profits.

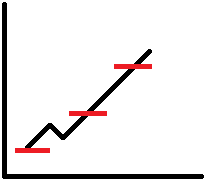

Standard Stop Losses

These are placed at a price you consider to be your worst-case scenario. A point at which you would no longer wish to be in the position, preferring to be closed out automatically at the current market price before losses get any worse/profits erode any further. Stop levels can be amended as often as desired but there are limits as to how close they can be to the price, depending on what you trade (Shares, Indices, FX, Commodities).

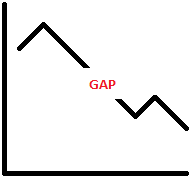

Note that prices can move straight through stops (‘gapping‘), if trading is volatile. With Stop losses being executed at the current market price, the gap down (or up, if you are trading short) could mean you are closed out at a different price to your chosen stop level. This risk is only avoidable by using Guaranteed Stops (see later).

Trailing Stop Losses

These are similar to Standard Stop losses, and bring us back to the point about letting profits run. The trailing stop is again placed at your worst-case scenario (‘gapping’ still possible), however, should the position move in your favour the trailing stop will ‘trail the move higher’.

For example, if you were Long, you could set the stop so that if the price moves up by 1%, the stop will also move up by 1%. This can help reduce any potential loss without needing to watch the position constantly and, if it the price keeps moving higher, and through the entry price, eventually be protecting profit.

Like a standard stop, there are limits as to how close they can be to the price, depending on what you trade (Shares, Indices, FX, Commodities). Standard Stops can be changed to trailing at any time and vice versa.

Guaranteed Stops

Like a standard stop, but with no risk of ‘gapping’. The guarantee requires payment of a small premium when the trade is opened. As always, there are limits as to how close the stop can be to the price depending on what you are trading.

Note this stop type is only available when opening a position and cannot be cancelled unless the trade is closed.

Key Tool

Most traders are happy to elect a worst-case scenario and put in a standard stop, but shouldn’t forget to amend them as their position moves into profit, to reduce risk or even lock in profits.

When a position moves into profit and a standard stop is left unchanged, profits are not protected and the price can always move all the way back to the entry point and even as far as the worst-case level (resulting in a loss).

Standard stops can always be changed to Trailing stops if the price is moving steadily in your favour, making the most of momentum to reduce risk and lock in profits so that when the price eventually moves against you the position can still be closed out automatically at a profit, breakeven or minimal loss.

It’ll come back

It is true that prices can fall all the way back to your entry point and then rebound, but is it not more profitable to exit with a profit and re-enter again at the original entry point with more capital to deploy? For the very aggressive, the return to the entry point could also be used as a short trading opportunity.

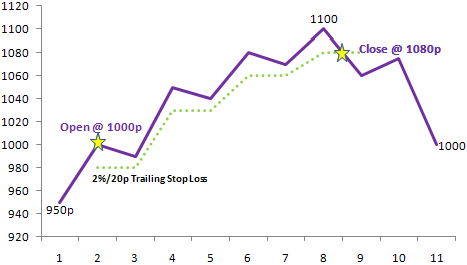

Illustration of a Trailing Stop Loss

For illustrative purposes only

1. Position opened at 1000p, with trailing stop 2%/20p away (980p)

2. As shares move up, stop revised automatically to remain 20p away

3. When shares reach 1100p, stop has moved up to 1080p

4. Position closed out at 1080p as shares fall, locking in 80p profit.