The information on this page is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

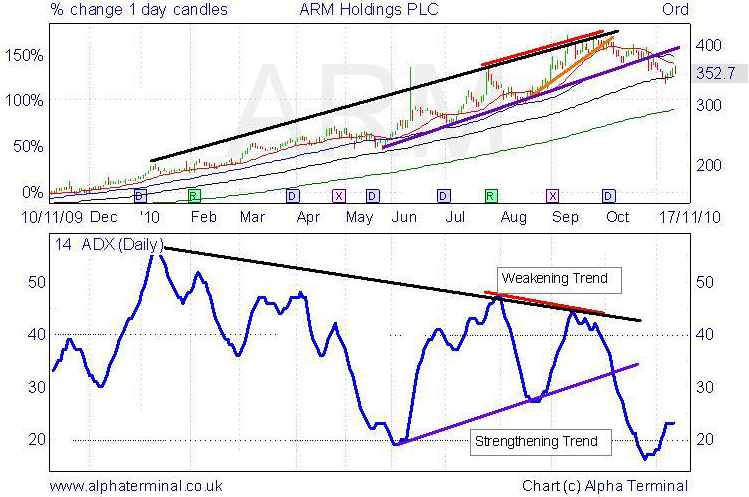

The ADX indicator can be found on your platform’s charting software. It is respresented in the image below by the blue line on the lower chart.

The ADX moves between defined extremes of zero and 100. A reading below 20 indicates a weak current trend, while a reading over 40 suggests strength. Readings close to zero and above 60 tend to be rare.

It does not indicate whether said trend is bullish or bearish – that is for you to confirm by looking at the share price chart.

Introduction

The ADX or Average Directional Index gauges the strength of a share’s current trend, whether shares are rising, falling, or moving sideways. It is helpful for identifying whether a trend is in place or not, as certain indicators work best when one is present. It is also helpful for investors looking to avoid trading against an existing trend – to trade only existing momentum. The indicator appears in the last column of our daily UK 100 Equity and UK Index Sector screenings.

Parameters

The ADX is an oscillator which moves between defined extremes of zero and 100. A reading below 20 indicates a weak current trend, while a reading over 40 suggests strength. Readings close to zero and above 60 tend to be rare. What is important to remember is that whatever reading the ADX gives, it only indicates the strength of the existing trend. It does not indicate whether said trend is bullish or bearish – that is for you to confirm by looking at the share price chart. Readings above 40 can be both bullish and bearish, depending on the direction the shares are moving. The ADX is formed from two other indicators, Positive and Negative Directional Indicators, which we will discuss at a later date.

Signals

As mentioned, ADX is useful in identifying strong trends, in order to help investors trade in the prevailing direction, trade the existing momentum, and so to avoid trades going against them.

Signals can also be derived from identifying crosses in the ADX from below 20 (low trend strength) and above 40 (high trend strength). For example, a move from 15 (low) up through 20 and on to 30 would suggest a strengthening trend. A move from 45 (strong) down through 40 and down to 30 would suggest a weakening trend. Nonetheless, a cross down through 40 only means a trend is weakening. There is still likely enough momentum behind the shares for a trend to continue further. Likewise, a cross up through 20 only suggests the trend is strengthening. It will probably need to keep moving in this direction a while longer for it to graduate to a classification of ‘strong’.

Additional signals can also be taken from divergence, where ADX shows a topping out and falling highs while shares keep rising, or where ADX shows a bottoming out and rising lows and shares keep falling. This can signal a potential for a reversal in the share price, however, as always, confirmation from the share price is always required before acting. Trendlines can also be used, where signal given when ADX breaks above falling highs or breaks below rising highs.

Black lines: Long-term trends: shares rising, ADX weakening – divergence.

Signals: ADX’s break down through 40. ADX break down through purple trendline.

Red lines: Short-term trends: shares rising, ADX weakening – divergence – signaling potential for share price weakness.

Signals: Share price fall through orange line. ADX break through purple trendline.

Conclusion

ADX is another helpful momentum indicator, offering signals derived from the underlying share price which can help increase the odds that a trade will ultimately prove profitable, by ensuring that momentum is in place. To date, our technicals’ caveats have highlighted the importance of respecting a share price’s current trend, and that pre-empting a move against the trend can often prove costly. The ADX makes an excellent first stop in the decision making process.

Caveat

As always, individual technical indicators should never be relied upon in isolation. They should be part of a trader’s decision making process. We always suggest interrogation of other indicators and price data (moving averages, trendlines, price, price patterns, support/resistance, volume) to assist with the final trading decision.